By Paul Gregoire and Ugur Nedim

Detectives from the State Crime Command’s strike force Quinlan raided the Doonside home of Shalin Patel last Tuesday. Police arrested the 22-year-old in relation to his alleged involvement in an identity theft syndicate.

The police claim that those involved in the scam ported more than 70 individual’s mobile phones from one carrier to another and then contacted these people’s banks to change their login and password details, which enabled them to steal more than $100,000.

Patel was registering the phones with Apple Pay, so he could purchase goods using other people’s cash, as well as transferring their money into overseas accounts. He stands accused of laundering up to $48,000.

Cybercrime Squad Commander Detective Superintendent Matt Craft said that cases involving the porting of mobile phones to commit financial crimes are becoming increasingly common. And these crimes have cost the community in the range of $10 million over the last 12 months.

Patel was taken to Blacktown police station, where he was charged with a range of offences, including one count of dealing with identity information with intent to commit an indictable offence and two counts of recklessly dealing with the proceeds of crime, also known as money laundering.

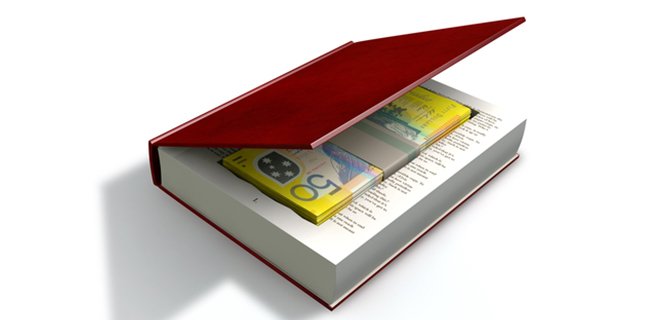

Hiding its origin

Money laundering is the taking of money that’s sourced from illegal activities and making it appear that it’s from a different source. The International Monetary Fund estimates that money laundering accounts for between 2 and 5 percent of the globe’s gross domestic product.

In NSW, a person can be charged with money laundering under either state or federal laws. Part 4AC of the Crimes Act 1900 (NSW) contains the state laws in relation to money laundering. Section 193B of the Act contains three money laundering offences with varying degrees of moral culpability.

Subsection 193B(1) stipulates that a person who knowingly deals with the proceeds of crime and intends to conceal that the money was sourced from criminal activity is guilty of an offence that carries a maximum penalty of 20 years imprisonment.

Subsection 193B(2) provides that a person has broken the law if they knowingly deal with such proceeds. This can see an individual locked up for up to 15 years. And subsection 193B(3) outlines that a person can be imprisoned for up to 10 years for recklessly dealing with criminal proceeds.

The term reckless refers to a situation where an individual would have foreseen the possibility that the money they were dealing with could have been the proceeds of crime and they continued to deal with it regardless.

The federal laws

Commonwealth money laundering laws are contained is section 400.3 through to 400.9 of the Criminal Code (Cth). Like the state laws, the penalties for these offences increase in gravity depending on the offender’s state of mind.

Although, the federal laws differ from the state laws, as they also take into account the value of the money or property involved in a money laundering operation. Section 400.3 of the Criminal Code makes it an offence to deal with the proceeds of crime or property worth $1 million dollars or more.

As NSW Court of Criminal Appeal Justice Graham Barr explained in the 2010 case R versus Li, this section creates a “graduated series of offences… varying in gravity according to the offender’s state of mind”.

If a person knowingly deals with $1 million worth of funds that has been sourced from criminal activity, or if they intend that the money is going to be used to commit a crime, they can be sent to prison for up to 25 years and/or receive a fine of $315,000.

However, if a person recklessly deals with $1 million worth of illegally sourced money a penalty of 12 years imprisonment and/or a fine $151,200 applies. But, if the individual is negligent of the fact the money was gained via crime, they can be sent away for up to 5 years and receive a $63,000 fine.

Section 400.7 of the Criminal Code makes it an offence to deal with the proceeds of crime or property worth more than $1,000. And if convicted of knowingly carrying out this crime, an offender can be sent away for up to 5 years and/or receive a fine of $63,000.

Sentencing factors

The number of transactions and the period of time when the transactions were made are significant factors that the courts take into consideration when sentencing an offender for the crime of money laundering.

A number of transactions involving smaller amounts of money is generally seen as more serious than just one single transaction involving a large amount, as the latter example is taken as a one-off, isolated offence.

Other important factors a judge will consider is whether the money belongs to the offender or someone else and the degree of planning that went into the criminal operation. And the use of false identities elevates the objective seriousness of an offence.

Justice Barr also stated in Li that although the number of money laundering cases the NSWCCA has been dealing with is growing, “it is still small”, so an “appropriate sentencing practice” has not yet developed.

But, the crime of money laundering is seen as a very serious offence, so the judiciary tends to impose tough sentences for anyone who breaks this law. And deterring others from partaking in this behaviour is of particular relevance for a judge when handing down a sentence for this crime.

Money working for him

In relation to the identity theft and money laundering syndicate Mr Patel was arrested over last week, NSW police said that it’s expecting to make more arrests and that further investigations will result in the uncovering of more victims.

Patel was released on bail last week and he has to appear in Blacktown Local Court on 11 April. And, while it seems to have been removed now, at the time he was arrested, his Facebook page said that he was in a process to not work for money, but to make money work for him.

Although, it seems that money has actually led him down a path that will probably result in his loss of liberty for a number of years.